Why Do I Owe Money on My Taxes This Year?

As this year’s tax season comes to an end, we can’t help but notice that this was a really tough year for our clients and their accountants. So many have been asking: why do I owe money on my taxes this year?

No one wants to owe money to the IRS, but this year it feels like there are more “surprises” than usual among our clients, who tend to be fairly high-income earners in their prime working years.

We know that 2021 was an unusual year, but so was 2020. Why does this year feel so different?

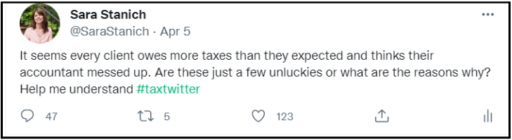

I decided to ask Twitter:

Clearly, I hit a nerve because I received over 40 responses. (I am usually more of a lurker than a poster on Twitter, so this was a lot for me.)

Broadly, the answers came down to a few things:

Unemployment income was not taxed in 2020 (but it was in 2021)

The W-4 changed, leading people starting new jobs to under-withhold

Many earned new or higher Self-Employment Income in 2021 vs. 2020

Capital gains were unusually large in 2021

Required Minimum Distributions (RMD) were canceled in 2020 but not 2021

Half of the Child Tax Credit was prepaid in 2021

People had lower itemized deductions after refinancing into lower mortgage rates

Here’s a little more detail and an explanation of each of these factors:

Unemployment Income Was Not Taxed In 2020 (but it was in 2021)

In 2020, there was a big spike in unemployment due to Covid-related shutdowns. Roughly 40 million Americans collected unemployment benefits that year. Unemployment benefits are typically taxed as income, but for 2020 the first $10,200 in benefits was excluded from tax for most households.

In 2021, this program was eliminated, and the taxation of unemployment benefits went back to normal. I know many parents who could not return to work as quickly as they might have due to childcare responsibilities (someone has to supervise Zoom school!), and in fact, roughly 25 million people received unemployment benefits in 2021. (Source)

So, if you received unemployment benefits in both 2020 and 2021, it would have been tax-free in 2020, but taxable in 2021. This is one reason why you might owe more on your taxes this year.

The W-4 Changed, Leading People Starting New Jobs to Under-Withhold

When you start a new job or sign up for payroll, you complete a tax-withholding form called the W-4. It’s not exactly memorable, but this is what tells the employer how much tax to withhold from your paycheck based on marital status, number of allowances and dependents, and other factors. The W-4 is also called an Employee’s Withholding Allowance Certificate.

The form was changed in 2020, and a lot of people found the new form confusing. At the same time, a lot of people started new jobs in late 2020 and in 2021, in part due to the covid pandemic. So those people used this new form that was different from any payroll tax withholding form they have done before.

We have noticed that many people who recently started new jobs were under-withheld on their income taxes, and we suspect the new W-4 form is part of the reason they owe money on their taxes this year.

[If this sounds like you, you may want to compare your paystub to the IRS tax withholding calculator to see if you should increase your withholdings.]

Many Earned New Or Higher Self-Employment Income In 2021 Vs. 2020

Many people have reassessed their life choices as a result of the Covid crisis. The wave of Americans changing jobs and careers over the last couple of years has been referred to as the “Great Resignation,” the “Great Reshuffle,” the “Big Quit” and the “Covid Pivot”.

This has led many to start a business that they have dreamed of and change their work life. What many did not realize was that as a W-2 employee, your income taxes are generally withheld throughout the year, and employment tax is paid by your employer. As an independent contractor or self-employed business owner, you need to make those tax payments yourself, and you may be subject to self-employment tax which you may not have been responsible for in the past.

If this applies to you, this could be another reason you may have had a higher tax bill this year.

Capital Gains Were Unusually Large In 2021

In 2021, the market hit record highs. This doesn’t apply to retirement accounts, but if you sold investments (including cryptocurrency!) in a taxable brokerage account either to rebalance or to buy property, you potentially incurred a taxable capital gain on the sale for which tax was not withheld. This would have appeared on your 1099 from your investment account.

Many mutual funds also had large capital gains distributions in 2021. Those distributions are often re-invested in the fund and remain in the account, but are still taxable. This is an area of confusion for many investors because money never leaves the account, and doesn’t leave the fund, but capital gains are taxed.

This “issue” made the news in recent months and maybe one more reason you owe money on your taxes this year.

Required Minimum Distributions (RMD) Were Canceled in 2020 but not 2021

If you are age 72 or older, you are required to withdraw funds from many types of retirement accounts, such as a 401(k) or a traditional IRA. Unless they are part of a Roth 401(k) (not a Roth IRA, which does not require RMDs), these mandatory withdrawals are taxable as income to you because they had not previously been taxed.

In 2020, the requirement to take these distributions was waived, so many opted to not take distributions from their account. For some who are over age 72, their income rose in 2021 when RMDs were reinstated, and as a result, their tax liability rose as well.

Half Of The Child Tax Credit Was Prepaid In 2021

Under the American Rescue Plan of 2021, advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. This was a new thing, and the idea is that instead of receiving a credit back when you file your tax return, parents would receive the money (up to $250/month per child) immediately to pay for child care and expenses.

However, the tax credit phases out over certain incomes, so many people who made more income in 2021 (vs 2020) would have been ineligible, but they got the check anyway. Now they have to pay the money back that they received in error.

This program has been discontinued, but some who received the payments but were not actually eligible for the full amount of the credit now pay the money back with the filing of their tax return.

Lower Itemized Deductions After Refinancing Into Lower Mortgage Rates

Mortgage interest rates are on the rise but were very low for most of 2021. Many homeowners used this as an opportunity to refinance their mortgage. Mortgage interest, up to certain limits, is a deduction for taxpayers who itemize. While, on balance, it is preferable to pay less in interest over the life of a loan, a downside of refinancing is that you will be able to deduct less on your tax return, which could be a reason you owe more money on your taxes this year.

In Closing

If you owe money this year, know that you aren’t alone. And while it never feels good to pay at tax time, it usually means you either made more money or paid less throughout the year.

If you do have a question about your tax situation, please reach out to us! As financial planners, we understand the importance of tax planning as a part of your financial plan. We may be able to help you find the answer or explain it more clearly.

Disclosure: This article is designed to be educational and is not tax advice. Please consult your tax advisor to discuss your individual situation.